-

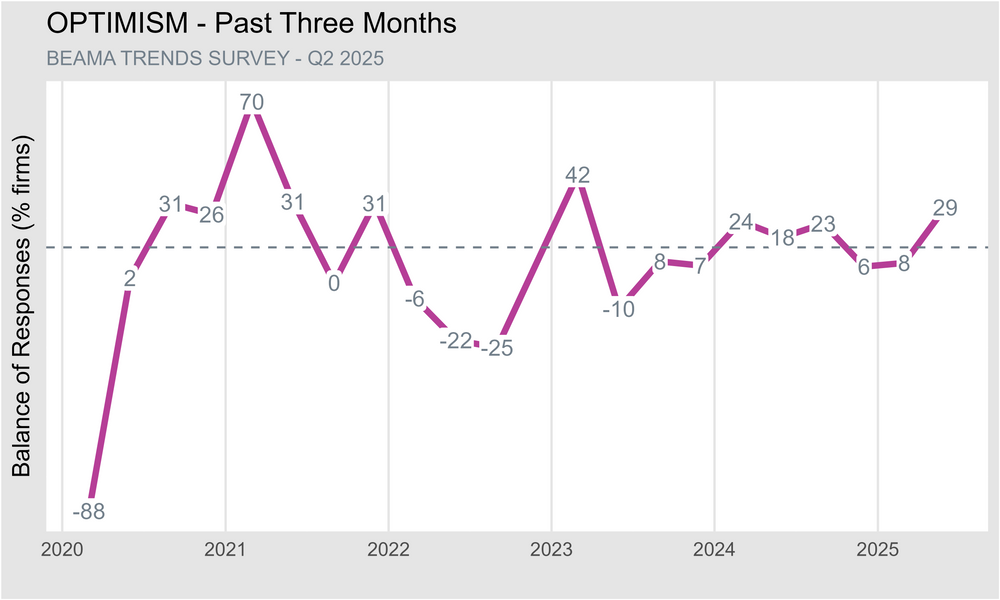

Business optimism jumps to its highest since over 2 years, despite sales reaching the lowest level since the pandemic

-

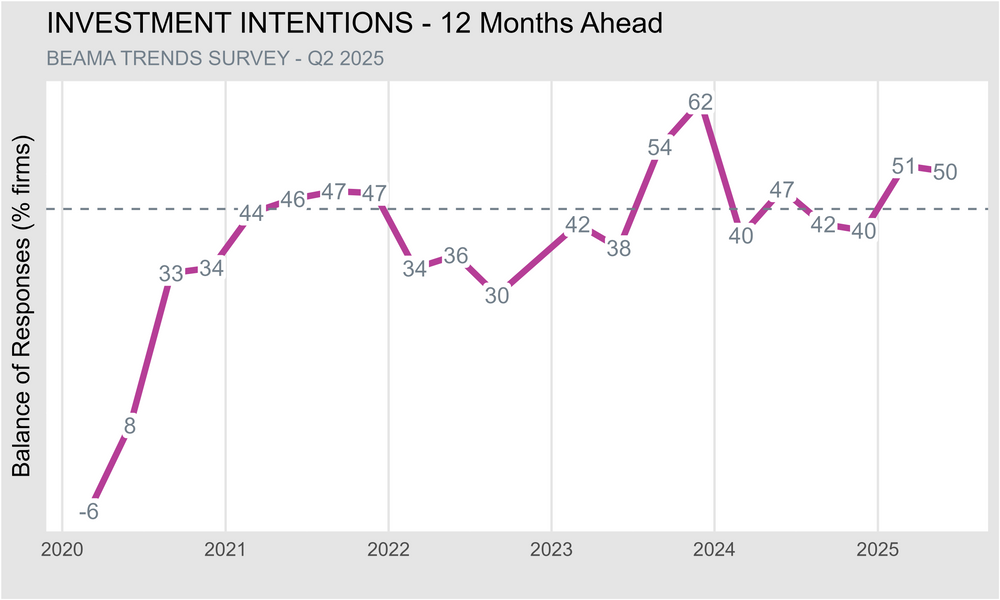

Investment intentions remain high as businesses seek to invest heavily into product improvements over the next 5 years

-

Export volumes rally to highest levels since late 2022 after a tumultuous period

-

On average, manufacturers supporting networks infrastructure expect turnover to double by 2035 and employment to more than double

The electrical supply chain industry saw a sharp rise in business confidence in Q2 2025, well above the five-year average, even as sales dropped to their lowest levels since the pandemic.

On National Manufacturing Day, BEAMA, the trade association representing 200 UK manufacturers of electrical products vital to the UK’s efforts to modernise the grid and decarbonise, has published its latest Market Pulse report as part of the #AcceleratingElectrification campaign. The findings reveal a welcome boost in optimism across the sector driven by the prospects of trade deals and UK Government strategy.

This marks a dramatic turnaround from Q1, when sales were strong, but optimism was low. Despite weaker sales, driven in part by seasonal factors and delays to major projects, sentiment has now shifted in a more positive direction.

However, overall sales volumes declined sharply as part of a more nuanced picture for manufacturers. While 40% of members still reported growth, the impact of delays to orders from trading uncertainty at the start of 2025 has had a knock-on effect. Optimism will also have been boosted from a significant recovery in exports too, above the five-year average, further demonstrating the sector’s value to UK Plc. painting a more nuanced picture than the headline figures suggest, and looking ahead, 95% of respondents expect to maintain or increase sales in the coming months, helping explain the surge in confidence.

Optimism is also underpinned by strong investment intentions, which also bounced back above the five-year average in early 2025 after a sluggish 2024, and remain high. The majority of planned investment is directed towards product improvement, with previous years’ focus on R&D now translating into solutions. Plant and equipment are also targeted for investment as businesses prepare for increased output to meet the growing demand anticipated. With 95% of respondents expecting to maintain or increase sales in the coming months, the continued optimism and investment intentions are reliant on a stable trading environment globally and the continued policy commitment in the UK.

For the first time, this quarter’s Market Pulse report gives an indication of the size of the network manufacturing sector and its contribution to the UK economy. The average company supporting the networks sector expects their UK turnover to double by 2035, and their UK employment to more than double, indicating the essential part the electricity supply chain will play in driving economic growth and prosperity.

Yselkla Farmer, CEO of BEAMA says:

“The progressive package of measures stemming from the Industrial Strategy is clearly driving the optimism we are seeing from manufacturers, and this is delivering for the UK economy. We have worked hard with Government to ensure the growth opportunities within our sector are acknowledged within the Industrial Strategy, including networks being identified as a foundational sector and recognition for the opportunities from the broader range of low carbon heat and hot water products that we hope will form part of the warm homes agenda in the UK.”

“Our members are right at the heart of the UK’s grid infrastructure upgrades and the push for clean power by 2030. We know the pressure on our supply chains is only going to increase in the months and years ahead. That’s a challenge for manufacturing capacity, but it’s one BEAMA members are ready to step up to and seize the opportunity for growth in the UK.

“The electrotechnical sector is encouraged by the government’s positive signals in its Industrial Strategy which supports this effort. Now is the time for clear and consistent action that helps secure the investments needed to deliver the growth that is essential for manufacturers, and the wider UK economy.”

BEAMA Member Comments:

Phil Dingle, Director of Future Networks, Lucy Electric

“The electrical supply chain in the UK has cause for optimism with the Industrial Strategy, the focus on investment in clean energy and the broad stability of the policy environment. British manufacturing businesses like Lucy Electric, which can demonstrate innovative engineering capabilities, are well place and ready to deliver on this critical mission for UK Plc. The appetite to invest in R&D, capacity and jobs is there, as BEAMA’s market pulse shows and that is linked to the a continued focus on electrification.”

David Pownall, VP Power Systems UK&I, Schneider Electric

"The Industrial Strategy is an important step in the right direction - providing certainty for UK businesses on the future policy framework. It identifies many of the key barriers to investment in the UK, such as high energy prices and skills gaps and a recognition of networks as a foundation sector. Businesses now need a measurable and transparent delivery plan and regular touchpoints with Government. The Industrial Strategy also marks a key opportunity for the government to go further in capturing the industrial benefits of grid build out, by utilising new public finance institutions, embracing regulatory reform, and modifying procurement practice."

"As shown in BEAMA's latest Market Pulse, and demonstrated by Schneider Electric's recent investments in Leeds and Scarborough, there is an appetite to invest but there are concerns that are holding back investment - most notably the lack of certainty of future demand. This uncertainty risks damaging domestic supply chains which need time to scale up production and manufacturing. This will in turn make it harder for the UK Government to achieve its targets around clean power, heat pumps and EVs."

Lee Sutton, Chief Innovation Officer, myenergi

Views on trends:

“We’re seeing the same thing BEAMA highlights – optimism is up, but now it’s about delivery. Electrification of heat and transport is driving everything, and demand-side flexibility is becoming essential. Our products are designed around that, so it’s good to see the system finally catching up. The real pinch point isn’t technology anymore, it’s skills – we need way more installers trained and ready.”

Barriers to investment:

“On the household side, the big barriers are still cost and confidence. Electricity is too expensive compared to gas, so heat pumps and electric hot water don’t feel affordable enough. The skills gap is huge – people can’t always find a qualified and competent installer, or the wait times are too long. Add in a lack of consumer awareness and some pretty poor press coverage, and you’ve got a recipe for hesitation. And when policy signals keep changing, homeowners end up waiting rather than investing.”

“From an inward investment point of view, policy stability is everything. Hints about watering down net zero commitments are not helpful – investors want clarity that the UK is all-in. A benign and competitive tax regime also matters; if international investors can get better returns elsewhere, the UK risks losing out on capital that could otherwise build factories, create jobs and scale supply chains here.”

Opportunities for growth & role of Industrial Strategy:

“The real growth story is flexibility. Vehicle-to-grid, home batteries, smart charging – we’re talking gigawatts of flexible capacity if we get this right. Export markets are already bouncing back too, so the UK can lead here if government holds its nerve. The Industrial Strategy can really help by giving clear and consistent signals on grid upgrades, electricity pricing, skills and consumer incentives. And let’s not forget consumer education – cutting through misinformation and making the benefits clear is one of the cheapest ways to accelerate adoption.”

Views on Industrial Strategy Program:

“Overall we’re supportive of the Industrial Strategy Program, it’s ambitious, and it puts our sector in the spotlight, which is exactly what’s needed. Business confidence is definitely up. But government needs to be careful not to turn ambition into endless rounds of consultation – the strategy already comes with new panels, committees and advisory groups.

“We need decisions and delivery, not just process. Also, while DBT talks about cutting red tape to boost competitiveness, other departments risk moving the other way – for example, DESNZ’s SSES proposals could become too prescriptive on interoperability and data, stifling innovation in what’s still a young industry. So yes, we’re supportive – but we want pace, clarity, and consistency above all.”

Jon Chamberlain, Managing Director, Marshall-Tufflex Ltd:

“At Marshall-Tufflex we are committed to investing in the long-term resilience and sustainability of UK manufacturing. In 2025 we are investing £2.5 million into our operations, including the development of our Manchester distribution depot to expand stock capacity and streamline logistics, as well as the installation of a new PVC-U conduit extrusion line to increase manufacturing output.

“Looking further ahead, we have also approved a £3.1 million investment programme over the next two years that will see the purchase of new robotic machinery, replacement of mould tools and extrusion equipment, and significant building upgrades to our Hastings facility. These investments will strengthen our ability to support customers, reduce our environmental impact, and ensure we are ready to meet the demands of a fast-changing electrical industry.”

Spencer Clark, Commercial Managing Director, Dimplex

“It is vital that the Warm Homes Plan continues to recognise that heat pumps are not always the best solution for existing housing stock, where a mix of alternative low-carbon technologies can bring significant benefits to housing providers and tenants as well as to the grid. Providers can improve EPC ratings by up to two bands by simply upgrading traditional storage heaters and direct-acting cylinders to high heat retention storage heaters (HHRSH) and hot water heat pumps, both of which are fast to install and easy to maintain.

“The energy efficiency improvement means that tenants can reduce heating costs by over 35%, alleviating the increasing pressures of fuel poverty. And all this brings increased grid flexibility too. There are 2 million UK homes heated by traditional storage or direct-acting electric heaters. Upgrading all of these to HHRSH would give 14GW of the total 16GW flexible load that NESO’s Clean Energy 2030 Report says will be required for a net zero energy system.”

Market Pulse data

The quarterly Market Pulse report tracks progress on the delivery of the UK’s 2030 and 2050 target, seeking to bridge the gap between projected supply chain delivery and actual figures spotlighting the UK’s journey to drive investment into the manufacturing supply chain. BEAMA has been analysing trends in the UK market closely for over 2 decades and conducts quarterly trends surveys with BEAMA members (approx. 200 companies).